Do you want to be rich? Do you want to retire early and live the life of your dreams?

Of course you do! However, how can you do that? That’s the real question, isn’t it?

One way to do this is to create a genius plan that turns you into an overnight momLeo, and for that, you can put on your thinking cap.

Until then, we can’t Let time slip away. Until we get our lucky idea, we have to make other plans. These plans may not have quick results, but in the long run, they save You make a huge ton of money. If you do it right, they can be enough for you to live out your sensual dreams.

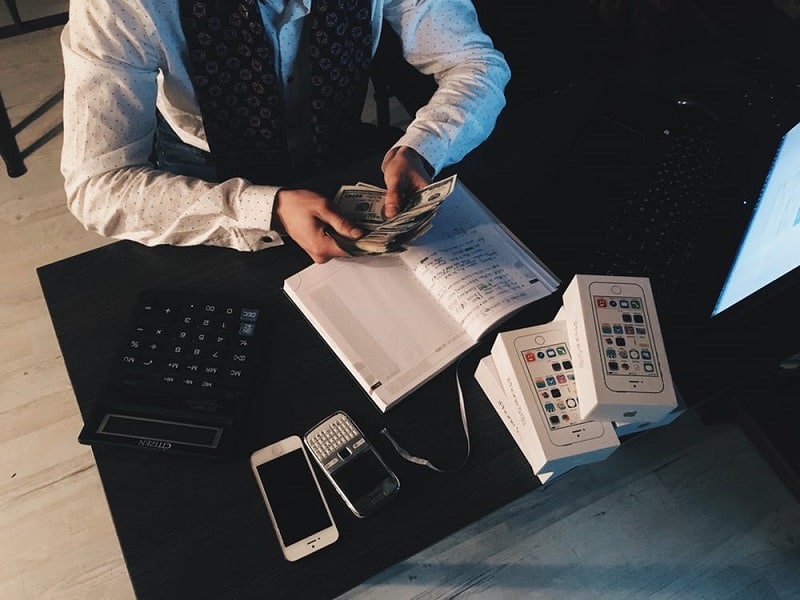

So, what is this plan? We are talking about financial planning.

Financial planning begins with an assessment of your current and past financial historyOri is right. This is done with an effort to draft the right strategy for your future.

You can be your financial manager. Follow these seven methods Save your money And get a well-secured future:

1. Monitor your spending

Are you one of those people who always complain about “no savings”? You earn a decent amount of money, but somehow there is nothing left at the end of the month, what is ito? If you answered “yes” to both questions, you need to sit down with a notebook and map out your expenses. You are overspending your budget.

You need to categorize your expenses into two columns – necessary and wasteful. Necessary expenses such as house rent, bike rental, etc can’t Compromise However, wasteful expenses like weekend parties, frequent shopping etc. can be deducted.

2. Clear your dues

House loans, college loans, or anything else you borrow from a financial institutionItuation or friend needs to be cleared immediately.

Over time, borrowed money only accrues interest and increases stress. Everything helps. Teaching your son too How to save money as a child.

3. Know your financial portfolio

You should evaluate your current spending habits and whether the savings hacks are in line with you Future goals.

Determine your aspirational expenses and start saving accordingly.

4. Set a timeline

For commercial purposes, there is usually a timeline. Say, you want to save for your child’s wedding or college, one guess would beed deadline for this.

In 20 or 10 years, your kids will need the funds. So, “By when will the sum be saved?” There should be a time limit for this. You can set a period that seems practical and accordingly you should start saving periodically.

5. Figure out where to bank those savings

As the rate of inflation increases, it is not enough to just save, you have to invest. When you spend, you let your money grow. If in modern times, you prioritize saving over investing, you’re letting yourself down Think of all the money you could have made as a gain on principal at a loss.

Investments can be made in various options. You can go for mutual funds, bonds, stocks etc. but these are subject to market movements. You could invest pPhysical metals such as gold and silver bullion for a more secure portfolio.

6. Don’t hesitate to ask for help

This may seem more natural to a financial advisor or professional, but for someone who is not well versed in business knowledge, investment matters can be complicated!

So, you should seek the help of professionals.

7. Regular check

This is probably an essential part of long-term planning. You should re-examine your financial plan from time to time.

Whether your investments are paying off can only be determined if you manage them frequently

No Comments

Leave a comment Cancel