Admit it. You signed up for a subscription service and completely forgot about it earlier Whether it’s an automatic shipment from Gevalia (what? Free coffee maker, right?!) or a gym membership that tricks you into forgetting about your sore muscles and comfy couches (too much to ignore), we’ve all wasted money on something. Which we weren’t using or needing.

Admit it. You signed up for a subscription service and completely forgot about it earlier Whether it’s an automatic shipment from Gevalia (what? Free coffee maker, right?!) or a gym membership that tricks you into forgetting about your sore muscles and comfy couches (too much to ignore), we’ve all wasted money on something. Which we weren’t using or needing.

Nowadays our life mainly consists of subscriptions. We subscribe to streaming services like Netflix, Hulu, HBO GO and more to get our entertainment solution Spotify for music. The New York Times for news We subscribe to household basics like toilet paper and vitamin supplements from Amazon. We get subscriptions for our coffee (Death Wish Coffee), razors (Dollar Shave Club), clothing (Stitch Fix) and even weird stuff like keto snacks, socks, dive bar shirts, monthly items and more.

Basically, we live in the age of subscriptions.

Sometimes we need regular reminders to monitor what we actually use, what we need, and how we can save ourselves money each month—and sometimes the Internet even gives us what we want. And Need Trim, “an assistant that saves you money”, our goal is to provide that reminder. Trim wants to automate saving money for its users, and one way to do that is by listing our subscription services: Trim shows us what we spend, where we spend it, and empowers us to save money on things we don’t use. Even if it could, it would cancel those services for us

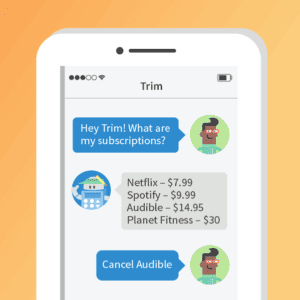

Here’s what Trim does: You sign up for an account and link your bank and credit card accounts to your Trim account. Then your personal financial assistant (it’s an AI) goes to work. Trim will analyze your transaction history line by line to identify recurring subscription costs. After it goes through all your data, you will receive a text message with a list of your subscriptions and their various costs. (You can also receive Trim messages through Facebook Messenger.) If you want to cancel something, just text Trim a command-pro-tip, the command is “cancel _____”. You fill in the blanks with the name of the service. If their automated system can do it, it will – either by emailing a form or making a phone call It will even send certified mail in some cases! (Note that, sometimes, Trim may require additional information to cancel a service.)

There are instances when Trim can’t automate cancellations for you – we all know that some companies require specific information from their customers before canceling and Trim can’t always answer those questions for you. In that case of course, they will inform you.

However, this “cancel my subscription” service? It’s completely free.

However, this “cancel my subscription” service? It’s completely free.

You don’t have to manually set the review of your subscription. Trim will regularly scan your account and send you messages when it notices a new subscription.

Trim can represent a great savings tool for those who are comfortable sharing their financial information with the company. On their FAQ page, Trim says they won’t sell your data, share it with third parties, or use it for any purpose other than analyzing it with their personal financial assistant. They also use 256-bit SSL encryption, encrypted databases, and two-factor authentication when you log in. Basically, Trim is saying that if you’re comfortable logging into your bank account online, you should be comfortable using their service.

It’s better if it’s true, right? Like, how is Trim making money if they do all this for free and don’t sell your data? Well, Trim does more than cancel your unwanted subscriptions. They activate cash back deals and flag price drops on Amazon. They negotiate lower bills for you for some services—most notably, for now, your cable and Internet bills. When they successfully lower your cable bill, they take a percentage of the money you save. They’re also automating that process, and hope to expand the service to include student loan payments, car insurance, and more in the future.

I highly recommend taking a close look at your expenses, whether in person or through a service like Ask Trim. We recently realized that we were spending about $150 per month on subscriptions that we don’t really need or use anymore. And if that’s money you’re not really losing anyway—obviously, since you haven’t taken the time to cancel up to this point—it’s money that could easily be rerouted into some sort of retirement savings. According to Start Late, Finish Rich – one of my all-time favorite books for beginners looking to build wealth – investing just $150 a month for 30 years can lead to nearly $340,000. How can you pass that up? If you can squeeze out $450 in savings and canceled subscriptions, you could be looking at over $1 million in 30 years.

Give Trim a try if it sounds like something that could benefit you and your wallet – and be sure to let me know how the experience goes! If Trim successfully saves you money, we all want to hear about it.

No Comments

Leave a comment Cancel